Assets Declaration Scheme 2019

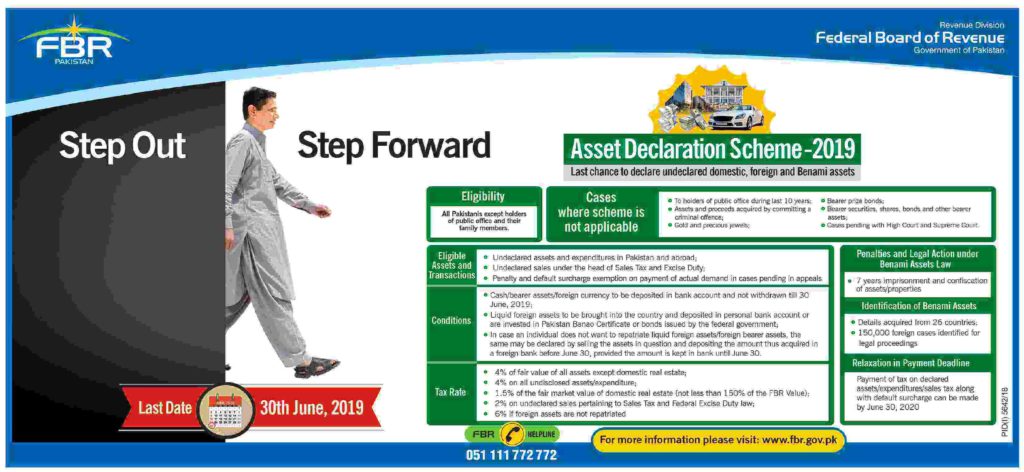

The Federal Board of Revenue (FBR) has advised that all individuals and the people associated with businesses, who have not yet filed their Income Tax Returns due to any reason, can file their returns now under Assets Declaration Ordinance-2019. This means that this is a special event for the Non-Filers to file their taxes.

According to FBR, this Ordinance provides one last chance to them to file Income Tax Returns. For this all government institutions including the commercial banks are extending their full cooperation.

The Federal Board of Revenue (FBR) has issued a Declaration Form under Asset Declaration Ordinance 2019 for persons availing the Assets Declaration Scheme.

According to the Declaration issued under Asset Declaration Ordinance 2019, the person availing the scheme would declare: “I hereby declare that any declaration by misrepresentation or suppression of facts shall render such declaration void and shall be deemed to have been never made under Assets Declaration Ordinance, 2019.“

The Declaration, available on the IRIS FBR’s online portal, also specifies domestic assets, owned assets, Benami assets, foreign assets, undisclosed -expenditures, undisclosed sales and payment of tax demanded and tax payable. The declaration also included description of asset along with the proposed tax rates, cost of acquisition, fair market value and tax in Pak rupee.

Visit this Weblink to see FBR website for Assets Declaration detail. Or you may visit the links provided in below:

| S.No. | Items | Links | |

|---|---|---|---|

| 01. | File your Declarations | File – Asset Declaration 2019 | |

| 02. | Payment of Taxes | Pay – Asset Declaration 2019 | |

| Create PSID for: | Tax on Foreign Assets (USD or AED) |

Tax may be paid either in USD or AED and PSID will specify the liability in desired currency 1. Complete the Asset declaration and create PSID from the FBR portal 2.Request your banker to remit the funds to either NBP New York ( for US$ payment) or UBL Dubai (for AED payment) depending upon the currency of remittance opted by you. 3. Request your banker to include following information as a part of message in the relevant fields: a. PSID# b. CNIC c. Date of birth d. Place of birth 4. NBP-Karachi will issue eCPR for payment. For details please refer to SBP Notification For help please contact SBP helpline |

|

| Tax on Domestic Foreign Currency Account (USD) | |||

| Tax on Domestic Assets/ Sales/Expenditures/Tax Demanded (PKR) | |||

| 03. | Frequently Asked Questions | FAQs – Asset Declaration 2019 | |

| 04. | Complete Taxpayer Information Guide | Assets Declaration Scheme 2019 – English Booklet | |

| Assets Declaration Scheme 2019 – Urdu Booklet | |||

| 05. | Guide for Online Registration & Filing | Registration Guide for Individuals – Asset Declaration 2019 | |

| Declaration Filing Guide – Asset Declaration 2019 | |||

| 06. | State Bank Notifications & Help | State Bank Notifications & Help | |

| State Bank Circular regarding Assets Declaration Ordinance, 2019 | |||

| 07. | Relevant Law | Assets Declaration Ordinance, 2019 | |

| Asset Declaration (Procedure and Conditions) Rules, 2019 – S.R.O 578(I)/2019 | |||